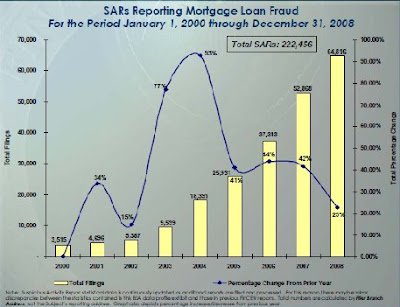

The chart shows that the largest percentage increase in filings was in 2003 and 2004, during the height of the housing bubble. The information should make us reconsider the argument that consumers were tricked by mortgage sellers into housing that they could not afford. At least the kind of massive fraud that Secretary Geithner commented upon back in March. Geithner's comments were about the incentives of financiers to engage in fraud a case that these numbers do not speak toward.

The data is only filings and as we learned when Harry Markopolos' repeated calls for Bernard Madoff to be investigated by the SEC reporting a suspected fraud doesn't mean that anyone is going to do though follow up. Even if firms were reported by a few savvy customers they may have continued to operate.

They may also have gotten more savvy themselves about not getting caught. This may explain the slow growth in fraud filings during the current crisis.

No comments:

Post a Comment