The Federal Open Market Committee just released its policy statement. No major surprises here. The Federal Funds Rate is staying in its 0 to .25 range. For some time I’ve been using the compare function of MS Word to track the changes in the FOMC’s statements. The function which is meant to find revisions in updated versions of the same document works surprisingly well for the FOMC. In other words, there are not a whole lot of changes between statements. The minimalist approach means that I’m going to each change got Joyciean attention (James Joyce was rumored to have ceased writing for days simply to fixate on one word that he wanted to get right).

So here are this month’s changes. The Fed is

1. Shifting the winding down of the MBS purchases into the present tense.

2. Says firms are “reluctant to hire” rather than the active cut backs from last month.

3. Eliminates the phrase “the fed is monitoring the size and composition of its balance sheet”

4. Has reaffirmed its commitment to end most of its special programs by February 1, 2010.

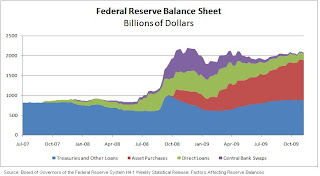

I’m still watching the balance sheet, given that, as the chart above shows it’s still double the size that it was before the crisis began. Additionally, it's the red section of the chart, direct asset, purchases that is growing and likely carries the most risk. Just as Treasury has called the Capital Purchase Program closed even while sitting on nearly $100 billion of potentially toxic assets, the Fed may be stuck with a good deal of garbage for a long time.

No comments:

Post a Comment