A new Rasmussen poll indicates that 48 percent of likely voters disagree with a plan to pay for health reform by imposing a tax on people making $250,000 a year or more. Yet only less than 2 percent of Americans actually make that much. Not to mention that we know at least some prominent members of the 2 percent, including the President, not only support such as tax but are actively seeking to enact it. So, more than 46 percent of Americans oppose a tax that they would not pay. There are likely two selfish reasons why.

In part, Americans don’t trust the government’s assertions that taxing just the rich can pay for the program. The same poll 78 percent of voters think that it is “very/somewhat likely” that taxes on the middle class will rise to fund the program. The Obama administration has proposed previous taxes on those making above more than, $250,000, in particular to patch Social Security. AEI scholar Andrew Biggs argued that tax plan would fail to solve that programs finances, and Americans understand why.

The other likely solution is that Americans are aspirational and hope to become a part of the upper 2 percent one day. Some cynics argue, as poll during the 2000 election shows, that at least some Americans mistakenly place themselves higher in the income distribution than they belong. Yet even with such miscalculations Americans target the long haul. In the latest version of the Panel Survey of Income Dynamics , 23 percent of respondents expected that their children would have earnings "somewhat higher" than themselves, while 29 percent expect their children’s' top earnings to be "much higher" than themselves. Respondents don’t want to protect today’s rich, they want to ensure that they can become rich tomorrow.

Tuesday, July 21, 2009

Thursday, July 16, 2009

Econ Blog Community

The WSJ prints an article today on the rising fame of econo-bloggers. The article highlights the titans including Greg Mankiw and the most recent Nobel winner Paul Krugman. In an associated guide, the WSJ lists a suite of 30 econ blogs for the uninitiated.

I don't know whether to be encouraged or distressed that I already subscribe to 14 of their list and see the others at least occasionally?

I don't know whether to be encouraged or distressed that I already subscribe to 14 of their list and see the others at least occasionally?

Tuesday, July 14, 2009

Hiring at SEC

This morning, SEC Chairwoman Mary Schapiro will be grilled by members of House Financial Services on the direction for the SEC. The harshest fire will actually be levied against Schapiro's predecessors. Rep. Bachus (R-AL) and Rep. Royce (R-CA) both criticized the failure to catch Bernie Madoff.

Schapiro expressed "regret" about the Madoff fraud. A figure attached to her testimony (below) shows that Wall Street has simply increased the amount of trading to a level that overwhelmed the SEC staff.

So if you're into finance, and don't want your compensation scrutinized in public, the SEC may be willing to take your work.

According to Schapiro:

For example, to better enable our staff to conduct oversight of complex trading strategies and

products that exist in today’s markets, we are enhancing training for our staff and also recruiting additional professionals with expertise in securities trading, portfolio management, valuation, forensic accounting, information security, derivatives and synthetic products, and risk management.

Of course, Congress' concerns were about the quality not quantity of the SEC staff so hiring experts makes sense. In fact sub-committee Chairman Kanjorski is asking about the possibility of firings and accountability.

Friday, July 10, 2009

Consumer Confidence Falters

After rising for four straight months, the preliminary July confidence figure from the University of Michigan and Reuters delinted. While we won't get the final measure for two more weeks, the index fell more than 6 points and will definitely be lower than June even with potential revision.

I wrote previously about the increased volatility in this measure and how announcing a "recession" causes it to spiral downward. If we look at volatility than the previous four months are encouraging. The last time the index rose for four straight months was as the 2001 recession ended. There was a fall then but much less than today. Furthermore, the decline in this recession has been much more dramatic and will likely still take quite some time to recover to pre-recession levels.

Wednesday, July 8, 2009

Money Multiplier

In a guest post this morning on CFR's Follow the Money, Mark Dow provides a chart of the money multiplier and the Federal Reserve balance sheet. The data comes from a Bloomberg chart of the day, and he notes some issues with confirming it. While I don't have the Bloomberg data, public data sets from the St. Louis Federal Reserve's FRED database confirm the step drop in the M2 money multiplier.

The money multiplier begins a step decent in September of last year, just as Lehman Brothers failed,AIG had to be bailed out, and TARP passed. The FRED data shows a 95 percent decline in the money multiplier since August of last year.

This decline creates major problems for the stimulus bill as each dollar spend produces less benefit. I wrote about Dr. Larry Summers' belief in the money multiplier and it's ability to increase the size of the stimulus back in January.

Tuesday, July 7, 2009

Mortgage Fraud Fillings on the rise

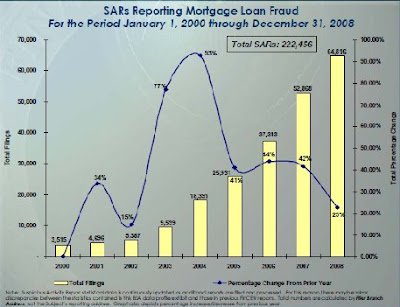

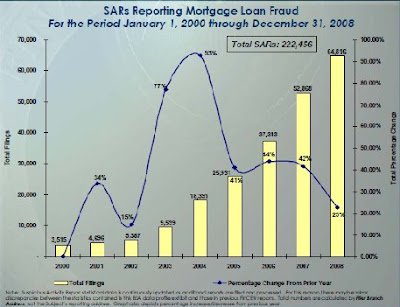

New data from the US Treasury's Financial Crimes Enforcement Network shows that fraud claims in the mortgage market rose in 2008. The absolute increase is unsurprising as the total number of filings has risen every year since 2000. More surprising is the rate of change of filings (the line graph in the figure below).

The chart shows that the largest percentage increase in filings was in 2003 and 2004, during the height of the housing bubble. The information should make us reconsider the argument that consumers were tricked by mortgage sellers into housing that they could not afford. At least the kind of massive fraud that Secretary Geithner commented upon back in March. Geithner's comments were about the incentives of financiers to engage in fraud a case that these numbers do not speak toward.

The data is only filings and as we learned when Harry Markopolos' repeated calls for Bernard Madoff to be investigated by the SEC reporting a suspected fraud doesn't mean that anyone is going to do though follow up. Even if firms were reported by a few savvy customers they may have continued to operate.

They may also have gotten more savvy themselves about not getting caught. This may explain the slow growth in fraud filings during the current crisis.

The chart shows that the largest percentage increase in filings was in 2003 and 2004, during the height of the housing bubble. The information should make us reconsider the argument that consumers were tricked by mortgage sellers into housing that they could not afford. At least the kind of massive fraud that Secretary Geithner commented upon back in March. Geithner's comments were about the incentives of financiers to engage in fraud a case that these numbers do not speak toward.

The data is only filings and as we learned when Harry Markopolos' repeated calls for Bernard Madoff to be investigated by the SEC reporting a suspected fraud doesn't mean that anyone is going to do though follow up. Even if firms were reported by a few savvy customers they may have continued to operate.

They may also have gotten more savvy themselves about not getting caught. This may explain the slow growth in fraud filings during the current crisis.

Labels:

fraud,

Madoff,

Markopolos,

Mortgages,

US Treasury

Thursday, July 2, 2009

Financial Sunset in California

I've got a piece today over at TCS Daily on the budget crisis in California. The state is set to begin issuing IOUs at 2pm Pacific time today. I conclude that CA's budget crisis could presage the likely outcomes for the US Federal government is nothing is done about spending, Social Security, or Medicare/Medicad costs.

I'll try to tweet updates on CA via www.twitter.com/apumich

I'll try to tweet updates on CA via www.twitter.com/apumich

Subscribe to:

Posts (Atom)